Should Congress Increase FDIC Insurance Limits?

South State Correspondent

MAY 9, 2023

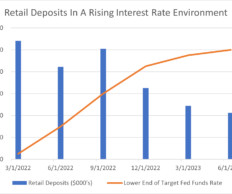

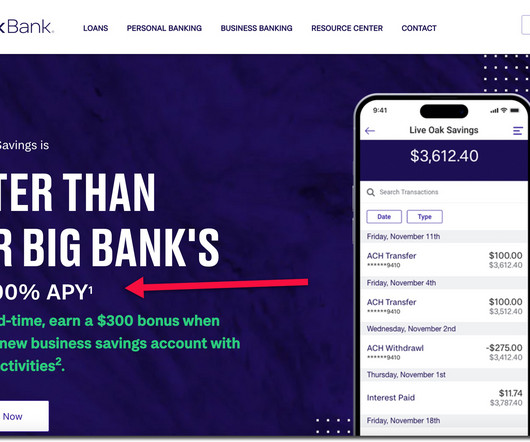

In the wake of regional bank failures, one potential answer to equity shorting and bank runs is having the FDIC increase deposit insurance. private and public lending markets are the world’s envy, with a wide availability of financing options for many capital seekers across the entire capital stack. economy needs.

Let's personalize your content