US Banks Expected To Lose 200K Jobs To Technology

PYMNTS

OCTOBER 1, 2019

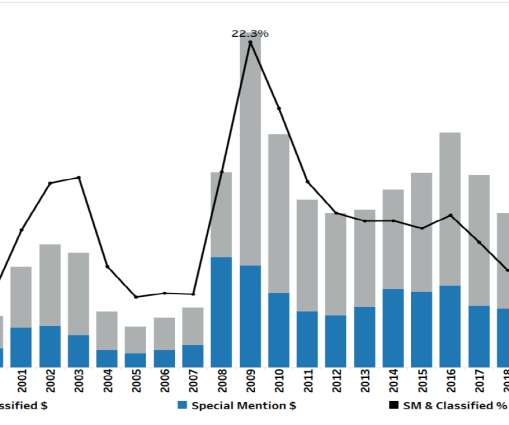

Federal Deposit Insurance Corporation (FDIC) data, however, shows that the industry’s overall headcount has shrunk only 16 times as of 1935. According to a report in January, citing Calculated Risk, last year was the first time since 2006 that not one U.S. In separate news, U.S.

Let's personalize your content