If You Are Tired of Being Transactional, You Need A Hedge Program

South State Correspondent

APRIL 30, 2024

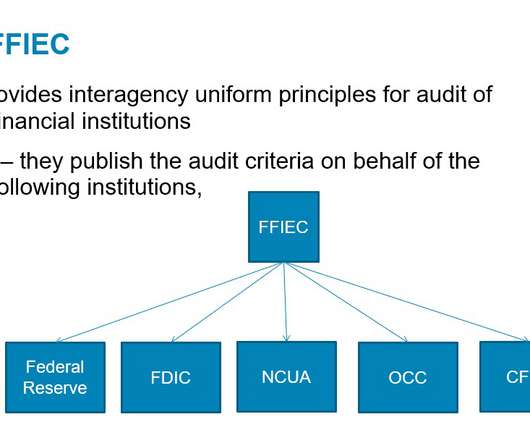

Eliminate Interest Rate Risk: Eliminate margin compression when interest rates rise. Meet Competitive Pressures : National and larger regional banks are specifically targeting better borrowers for five, seven, ten-year fixed-rate loans. This capital ratio is used to assess the possible riskiness of a hedge provider.

Let's personalize your content