Why community banks should partner with fintechs

Independent Banker

JANUARY 31, 2022

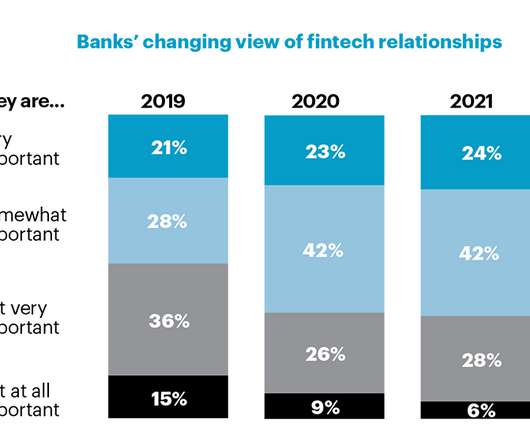

With consumer expectations seeming to evolve faster every year, community banks could consider partnering with a fintech to keep up with technological innovation. Swashbuckling, nimble, well-funded and unapologetically entrepreneurial, fintechs are offering innovations that allow community bankers to dream big in a host of ways.

Let's personalize your content