Fraud prevention and detection: Empowering clients through education

Abrigo

FEBRUARY 8, 2024

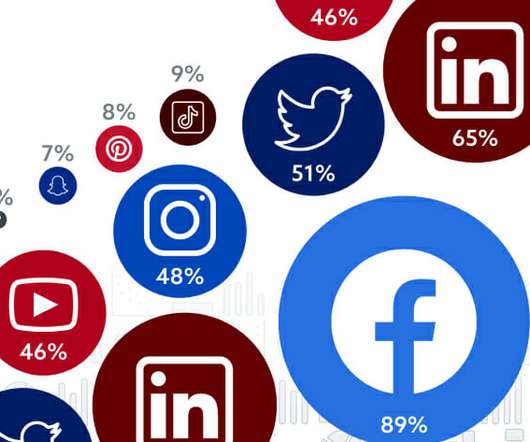

Clients should also be wary of social media scams. While interacting with friends and family online can be a fun pastime, social platforms are a feeding ground for fraudsters. billion was lost to fraud through social media between January 2021 and June 2023. According to the FTC , $2.7

Let's personalize your content