FDIC terminates consent order with Discover

Payments Source

AUGUST 31, 2017

A related agreement with the Federal Reserve Bank of Chicago remains in effect. The 3-year-old order was related to Discover Bank’s programs for combating money laundering.

Payments Source

AUGUST 31, 2017

A related agreement with the Federal Reserve Bank of Chicago remains in effect. The 3-year-old order was related to Discover Bank’s programs for combating money laundering.

American Banker

DECEMBER 16, 2020

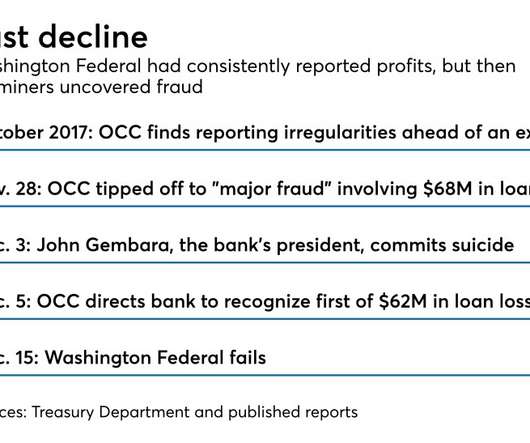

Bansley & Kiener, without admitting wrongdoing, agreed to pay $2.5 million to address allegations that lax oversight contributed to the 2017 collapse of Washington Federal Bank for Savings.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

American Banker

JULY 16, 2020

The proposed Chicago de novo would focus on serving female entrepreneurs.

American Banker

AUGUST 5, 2016

The former officers and directors for Midwest Bank & Trust have reached a $26.5 million settlement with the Federal Deposit Insurance Corp. over charges of negligence during the financial crisis.

PYMNTS

APRIL 7, 2016

The FDIC warned mainstream banks about buying marketplace debt, and the CFPB has set up a special desk for marketplace lending-based complaints. The Office of the Comptroller of the Currency said last week it was seeking comments on a whitepaper on “responsible innovation” in marketplace lending.

Abrigo

FEBRUARY 12, 2020

That’s just the beginning,” warned the Chicago Tribune less than a week earlier. CRE loan performance metrics at FDIC-insured institutions are strong, although institutions with CRE concentrations may be vulnerable to economic changes,” The FDIC said in its 2019 Risk Review.

American Banker

AUGUST 29, 2020

The Justice Department alleges that the bankers worked with “higher-ranking bank officials” at Washington Federal Bank for Savings in Chicago to falsify records and hide funds prior to the bank's December 2017 collapse.

Let's personalize your content