First Women's Bank receives conditional approval from FDIC

American Banker

JULY 16, 2020

The proposed Chicago de novo would focus on serving female entrepreneurs.

American Banker

JULY 16, 2020

The proposed Chicago de novo would focus on serving female entrepreneurs.

Abrigo

FEBRUARY 12, 2020

That’s just the beginning,” warned the Chicago Tribune less than a week earlier. CRE loan growth at community banks has been outpacing noncommunity banks, both in the quarter and over the last year, according to the FDIC’s latest Quarterly Banking Profile. . Watching for CRE red flags.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Independent Banker

JUNE 30, 2022

The Peoples Bank helped the Jones family of Legacy Dairy in Hiseville, Ky., From left, Ally Jones; bank chairman, president and CEO Terry L. Last year, community bank loan producers were faced with both record-low interest rates and a glut of deposits. The bank provides crop insurance to farmers in 11 states.

Abrigo

JUNE 11, 2021

As recently as May 2021, regulators identified interest rate risk as among the key risks in the economy, financial markets, and the banking industry that could affect insured institutions. The large increase in deposits coupled with decreased loan demand pose interest rate risk challenges for banks,” the Federal Deposit Insurance Corp.

American Banker

AUGUST 5, 2016

The former officers and directors for Midwest Bank & Trust have reached a $26.5 million settlement with the Federal Deposit Insurance Corp. over charges of negligence during the financial crisis.

American Banker

AUGUST 29, 2020

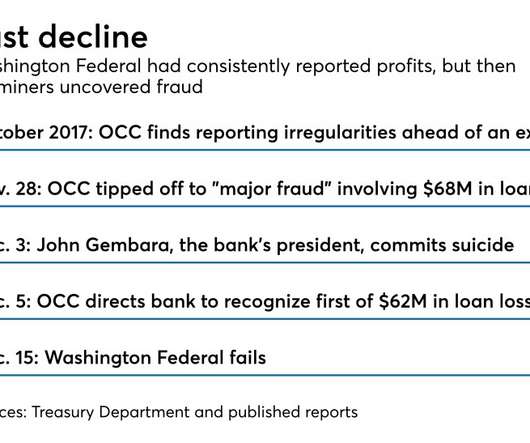

The Justice Department alleges that the bankers worked with “higher-ranking bank officials” at Washington Federal Bank for Savings in Chicago to falsify records and hide funds prior to the bank's December 2017 collapse.

American Banker

FEBRUARY 28, 2022

(..)

Let's personalize your content