2020 CRE Outlook: Trends Expected to Shape Commercial Real Estate Lending

Abrigo

FEBRUARY 12, 2020

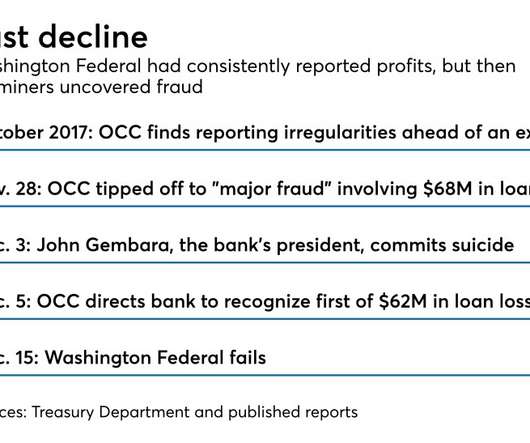

That’s just the beginning,” warned the Chicago Tribune less than a week earlier. Despite the painful evolution in retail, many experts expect another year of growth for commercial real estate – and for commercial real estate lenders, including community financial institutions. Watching for CRE red flags.

Let's personalize your content