Derivatives Usage By Community Banks

South State Correspondent

JULY 19, 2023

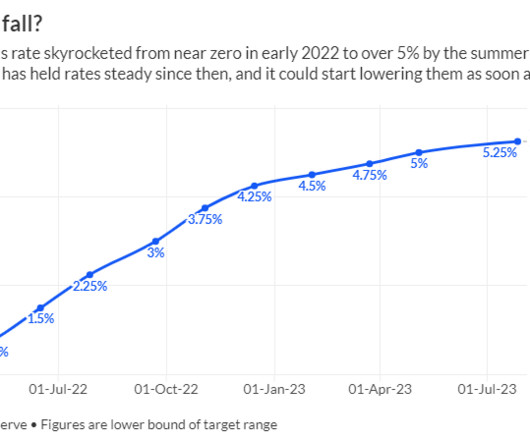

Of the largest 250 banks, 90% are using interest rate swaps, and because these largest 250 banks hold 83% of all loans, interest rate hedging tools are widely used in approximately 75% of the loan marketplace. The market expects deposit betas to increase through 2023 and 2024.

Let's personalize your content