1Q 2024 Commercial Relationship Credit and Pricing Trends

South State Correspondent

FEBRUARY 29, 2024

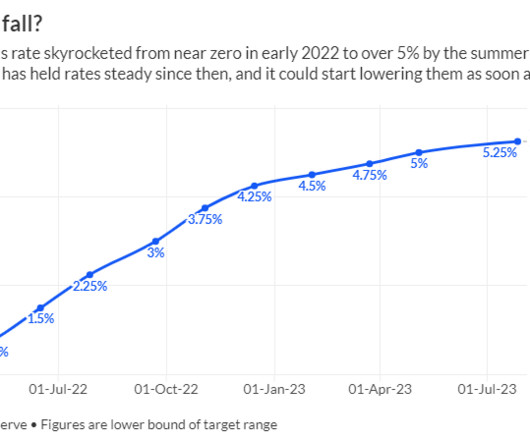

Since our last update on pricing and credit HERE , commercial loan pricing trends for the first quarter of 2024 continue to be driven by the perceived increase in credit risk, tighter credit supply and banks’ need for wider margins. percentage points bringing forward looking LGD to 44% of the average community bank loan amount.

Let's personalize your content