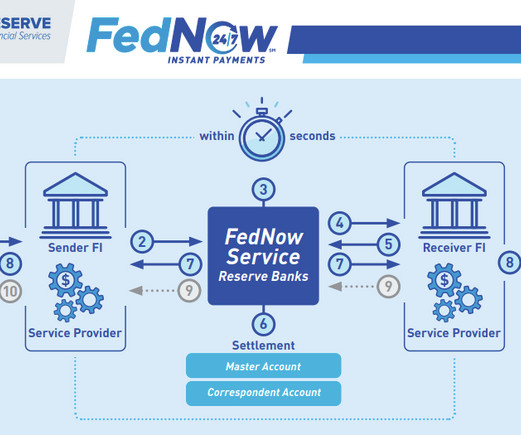

FedNow spurs industry intrigue

Payments Dive

APRIL 17, 2023

Financial institutions, payments players and other businesses are being drawn in by FedNow, according to survey results presented at the Nacha Smarter Faster Payments conference.

Payments Dive

APRIL 17, 2023

Financial institutions, payments players and other businesses are being drawn in by FedNow, according to survey results presented at the Nacha Smarter Faster Payments conference.

CFPB Monitor

APRIL 17, 2023

On April 6, 2023, the U.S. Department of the Treasury released a report examining vulnerabilities in decentralized finance (“DeFi”), including potential gaps in the United States’ anti-money laundering (“AML”) and countering the financing of terrorism (“CFT”) regulatory, supervisory, and enforcement regimes for DeFi. The report concludes by making a series of recommendations, including the closing of “gaps” in the application of the Bank Secrecy Act (“BSA”) to the extent that certain DeFi ser

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

APRIL 17, 2023

The partnership between the money transfer company and the global retailer will bring MoneyGram’s services to about 500 Carrefour locations next year.

CFPB Monitor

APRIL 17, 2023

On April 26, 2023, the CFPB will hold a field hearing in Brooklyn, New York on “zombie second mortgages.” At the event, Director Chopra will host a discussion with local community organizations, advocates, leaders, and members of the public about such mortgages and debt collection issues. The CFPB describes “zombie second mortgages” as “debts that consumers thought were satisfied long ago by loan modifications or bankruptcy proceedings or that were written off by lenders as uncollectable.”.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

The Banker

APRIL 17, 2023

A simple framework could help senior financial services leaders embed organisational resilience and proactively navigate the evolving risk landscape, according to Torry Berntsen.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

APRIL 17, 2023

Southern Bancorp Chief Innovation Officer Vance Smiley focuses on in-house innovation to solve client friction within wealth management and access to capital. “We’re focused on identifying problems first and then being methodical about looking for solutions,” Smiley told Bank Automation News.

The Banker

APRIL 17, 2023

Ask the average person on the street what a bank is and you may be surprised by the answer you get. Is a smartphone app that helps you manage your finances a bank? What about your favourite travel operator that provides financial services? The bank is being redefined and reshaped, Anita Hawser writes.

BankInovation

APRIL 17, 2023

Citi is investing in platform and process simplification, security and infrastructure modernization, client experience enhancements and data improvements.

The Paypers

APRIL 17, 2023

Apple has launched its Apple Card savings account with 4.15% interest rate.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

APRIL 17, 2023

Estonia-based first licensed entity to provide compliant crypto infrastructure in Europe, Striga, has launched a set of APIs to help crypto companies generate self-branded cards.

The Paypers

APRIL 17, 2023

UK-based online payment processor, Square , has recently announced a new integration across the UK with OpenTable , a global company operating in the restaurant technology field.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

American Banker

APRIL 17, 2023

The Paypers

APRIL 17, 2023

Global payment-processing corporation Mastercard has launched a suite of services dedicated to female business owners across Latin America and the Caribbean.

The Paypers

APRIL 17, 2023

Finastra has partnered with Alygne , a platform that provides tailored ESG alternative data to help asset managers make more informed ESG investments.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

APRIL 17, 2023

Commvault , a data protection and information management provider, and Microsoft have showcased the cost savings driven by their joint solutions.

The Paypers

APRIL 17, 2023

US-based cloud payments provider Volante Technologies has partnered with SouthState Bank to improve the latter’s payment options.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

APRIL 17, 2023

Mozambique-based Amaramba Capital Dealer has partnered with identity verification platform Shufti Pro to integrate KYC solutions.

The Paypers

APRIL 17, 2023

Paynetics has received its Electronic Money Institution (EMI) licence from the UK’s Financial Conduct Authority (FCA).

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content