Podcast: How Multigenerational Directors and Engaged Employees Drive Bank Independence

ABA Community Banking

MARCH 9, 2022

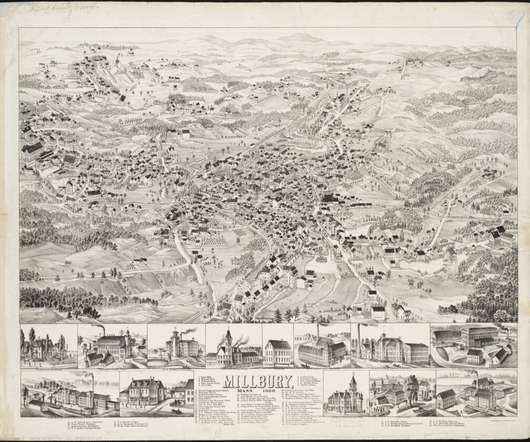

For nearly 200 years, Millbury National Bank has stayed independent as a commercially focused community bank in Massachusetts. Part of that independent tradition owes to the bank's history of multigenerational stewardship.

Let's personalize your content