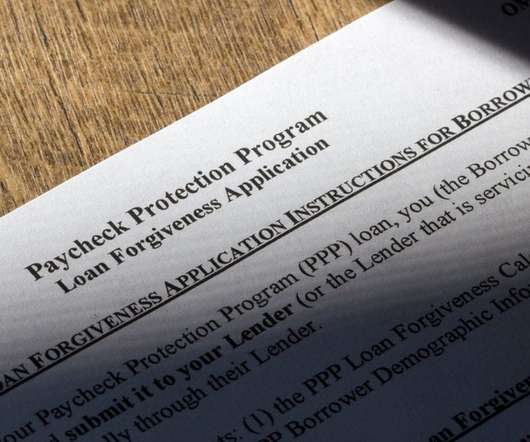

Today In B2B: Small PPP Loans Cause Controversy; Bank Profits Sink

PYMNTS

JANUARY 12, 2021

Plus, Pilot Company collaborates on fleet factoring, Revolution Payments launches Level III commercial card processing and Porter Capital launches new PPP funding tools. Nikki Smith, a baker and caterer in Oregon, collected $96. Porter Capital Offers New Funding Tools To PPP Recipients. bank profits are expected to sink.

Let's personalize your content