Fed, OCC to hold meeting on Capital One-Discover deal

Payments Dive

MAY 15, 2024

Concerns about the $35B merger proposal, which has already faced opposition, are likely to surface again at the July public meeting.

Payments Dive

MAY 15, 2024

Concerns about the $35B merger proposal, which has already faced opposition, are likely to surface again at the July public meeting.

South State Correspondent

MAY 15, 2024

Bankers have been taught to diversify their loan portfolio to reduce idiosyncratic (individual borrower) risk and to stabilize earnings. The thinking is that diversification-induced lending leads to banking resiliency. We believe that while lending diversification leads banks to lend more in normal times (especially for banks over $50B in assets) and does benefit the general economy, community banks should be careful in how and where they choose to diversify.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

MAY 13, 2024

Digital wallets have grown in popularity as consumers have become accustomed to the convenience and flexibility of contactless payments.

BankInovation

MAY 15, 2024

AI and generative AI applications continue to dominate conversations within the financial services industry, but implementing generative AI is near impossible if bank data isn’t standardized and accessible. What makes good data?

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

TheGuardian

MAY 16, 2024

Thirty-three constituencies, including two in London, will not have a single bank branch by the end of the year, says Which? The number of UK bank branches that have shut their doors for good over the last nine years will pass 6,000 on Friday, and by the end of the year the pace of closures may leave 33 parliamentary constituencies – including two in London – without a single branch.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

South State Correspondent

MAY 15, 2024

Bankers have been taught to diversify their loan portfolio to reduce idiosyncratic (individual borrower) risk and to stabilize earnings. The thinking is that diversification-induced lending leads to banking resiliency. We believe that while lending diversification leads banks to lend more in normal times (especially for banks over $50B in assets) and does benefit the general economy, community banks should be careful in how and where they choose to diversify.

Jack Henry

MAY 16, 2024

Soon, we will be back to “normal,” or at least something that resembles it. Promising vaccines are on the horizon. In some states, businesses are reopening. Holiday shopping is even underway. At the same time, millions of US-based businesses are preparing for 2021 and what it may bring. Through the sharp second quarter decline, many industry sectors saw gross revenues drop by more than 40%.

TheGuardian

MAY 14, 2024

Brighton event’s opening showcase scrapped after performers join Massive Attack and Brian Eno in boycott of sponsor Barclays More than 120 acts have pulled out of the Great Escape music festival in Brighton as part of a Palestine-related campaign against the event sponsor Barclays that has been supported by Massive Attack, Idles and Brian Eno. The festival’s opening showcase and a keynote speech have been scrapped after performers joined Bands Boycott Barclays, a campaign that claims Barclays Ba

Gonzobanker

MAY 16, 2024

Digital metrics at banks and credit unions are not all trending up and to the right. But there are some bright spots. A new report on digital banking metrics and the impact that digital banking is having on banks reveals some positive developments, but also a host of troubling trends that should give bank executives cause for concern. The fourth edition of the Digital Banking Performance Metrics study from Cornerstone Advisors, commissioned by Alkami, captures digital banking metrics from banks

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

Payments Dive

MAY 14, 2024

The retailer will add terminals to 3,000 of its Speedway locations and test services like cryptocurrency purchases with ATM solution provider FCTI.

South State Correspondent

MAY 13, 2024

Last week, Nacha held its Smarter Faster Payments Conference in Miami, a significant event for over 1,800 bankers and vendors. With 142 presentations and panels, the content was tailored to the needs of every bank interested in payments. The major themes of fraud, artificial intelligence (AI), expansion of instant payments, open banking, and regulation were particularly relevant to your roles as executives, risk managers, compliance officers, and technology leaders.

Jack Henry

MAY 16, 2024

FASB’s Accounting Standards Update (ASU) No. 2016-13 (more commonly referred to as CECL) was released earlier this year in June. At first look, the implementation dates for CECL are so far out that this project may not rank very high on a management team’s to-do list. Public business entities (PBEs) that are SEC registered have a regulatory reporting effective date March 31, 2020.

TheGuardian

MAY 12, 2024

Among world’s top 60 banks those in US are biggest fossil fuel financiers, while Barclays leads way in Europe The world’s big banks have handed nearly $7tn (£5.6tn) in funding to the fossil fuel industry since the Paris agreement to limit carbon emissions, according to research. In 2016, after talks in Paris, 196 countries signed an agreement to limit global heating as a result of carbon emissions to at most 2C above preindustrial levels, with an ideal limit of 1.5C to prevent the worst impacts

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

American Banker

MAY 15, 2024

As part of a sweeping digital enhancement of its consumer payment cards, Visa will enable banks to issue an account as a credit, debit, virtual or Pay in 4 installment loan, based on the user's preference at the time of purchase.

Payments Dive

MAY 15, 2024

The payments processing company plans to incorporate Revel’s point-of-sale capabilities into its SkyTab POS system, Shift4 CEO Jared Isaacson said.

ATM Marketplace

MAY 14, 2024

Cardless ATMs are paving the way for a more convenient banking experience by enabling Google and Apple Pay transactions.

Commercial Lending USA

MAY 14, 2024

Businesses can get low-interest commercial loans to help them with things like growing, buying tools, or keeping track of their inventory.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

TheGuardian

MAY 13, 2024

Younger homebuyers are turning to ultra-long loans, prompting fears over the risk to their finances and the wider economy For a long time the traditional length of a UK mortgage has been 25 years, but runaway house prices and, more recently, dramatically higher borrowing costs are prompting more and more people to “go long” on their home loans. On Monday, the former pensions minister Steve Webb revealed that younger homebuyers were increasingly being forced to gamble with their retirement prospe

American Banker

MAY 16, 2024

UMB Financial, Fulton Financial and Provident Financial Services have recently announced capital raises in connection with M&A deals. "They're setting a precedent," one consultant said.

Payments Dive

MAY 16, 2024

Fidelity National Information Services is targeting revenue growth of as much as 4.5% this year as it scans the landscape for “tuck-in” acquisitions following the spin-off of Worldpay.

BankUnderground

MAY 16, 2024

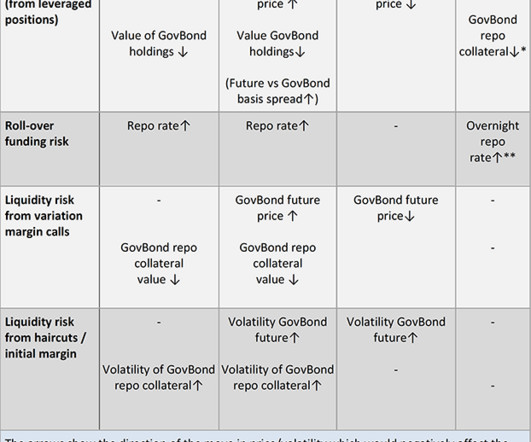

Adam Brinley Codd, Daniel Krause, Pierre Ortlieb and Alex Briers We both drive cars, but the US drives on the right while the UK drives on the left. We both walk, but we do so on sidewalks in the US and pavements in the UK. We both have asset managers, who want to take leveraged positions in interest rates. US asset managers had around US$650 billion of long treasury futures in June 2023.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

Commercial Lending USA

MAY 13, 2024

Explore Alternative Commercial Lenders with Commercial Lending USA. Fast approvals, flexible options, expert guidance. Contact us now!

BankInovation

MAY 16, 2024

To provide personalized customer experiences, TD Bank is developing AI technology, which has resulted in more patents for the company. “TD has filed more than 450 patent applications in relation to AI [since 2020],” Senior Vice President and Chief Architect Licenia Rojas said on May 15 during TD Tech and Innovation Day.

American Banker

MAY 14, 2024

Part of the Consumer Financial Protection Bureau's mandate is to educate consumers by providing reliable information. With its credit card late fee "report" and the associated rulemaking, it has failed to live up to that responsibility.

Payments Dive

MAY 14, 2024

The Federal Reserve Board said it has received some 2,500 comment letters regarding its Regulation II proposal to cut the fees that merchants are charged when they accept debit cards.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Let's personalize your content