Major growth forecasted for the mobile payment security software market

The Paypers

SEPTEMBER 5, 2023

A recent study from HTF MI has evaluated the mobile payment security software market, expecting it to grow significantly by 2028.

The Paypers

SEPTEMBER 5, 2023

A recent study from HTF MI has evaluated the mobile payment security software market, expecting it to grow significantly by 2028.

South State Correspondent

APRIL 4, 2024

Furthermore, high federal government debt does not just lead to higher interest rates but also poses economic, national security, and social challenges. By 2028, debt as a percentage of GDP will reach a historical high of 106% and will reach 200% by 2050.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Gonzobanker

SEPTEMBER 14, 2023

Heck, Apple reported in August that it secured more than $10 billion in deposits with its savings product in partnership with Goldman Sachs. While the Oklahoma bank secured an impressive 3,000 attendees for the first one, the events are really bumping these days. bank’s fintech partners.

PYMNTS

MAY 24, 2019

Even though more companies are turning to AI and automation for faster transactions and stronger data security, many are finding that humans still have a critical role in customer service. clothing rental market is projected to reach $4.4 billion by 2028. According to the Payments and The Platform Economy Playbook , the U.S.

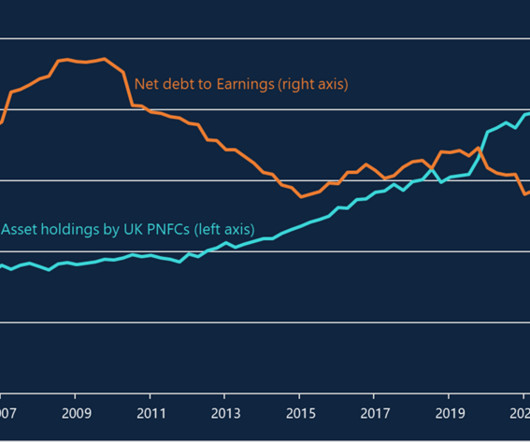

BankUnderground

MARCH 6, 2024

Paul and Zhou (2018) define refinancing risk as the potential inability of a borrower to secure new financing to replace existing debt coming due. Our data set is constructed from matching issuance-level market data with company accounts data across a given group’s ownership structure.

FICO

APRIL 13, 2022

Today, it is the preferred choice of payment in many countries, with the contactless market set to reach a global value of US$6.25 trillion by 2028. Europe and the UK are currently leading the market. For consumers, contactless payments have given them convenience, ease and security. What about for fraudsters?

CB Insights

MARCH 19, 2019

The increased security and speed made possible by 5G could allow users to make payments transactions instantly on their devices — much faster than any process today. Through the 5G network, applications such as real-time video, security communications, and media sharing could be used to assist first responders in emergency situations.

Let's personalize your content