Top Reasons to Promptly Upgrade Your AML Software

Abrigo

MAY 4, 2020

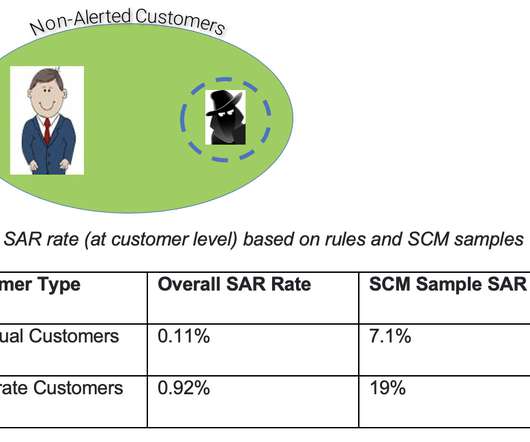

Key Takeaways You should always update your software to the latest version as soon as it's available. If you or your IT department are having issues keeping up with software updates, consider a hosted solution. How does this smart phone analogy translate to your AML software solutions? Learn more. Enhanced Functionality.

Let's personalize your content