Strategies for fighting remote authentication fraud

Independent Banker

NOVEMBER 30, 2021

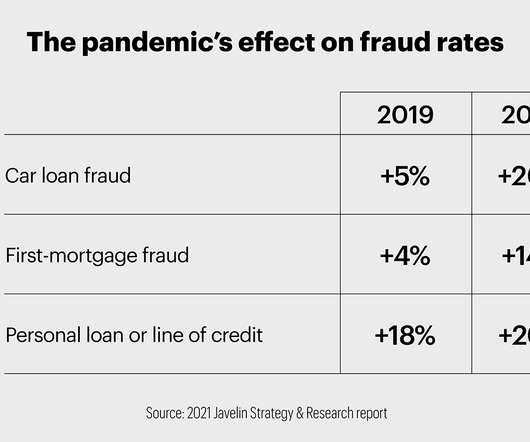

As more customers moved online, fraudsters took advantage of new and increasingly inventive opportunities to commit remote authentication fraud. Experts say community banks can use education, biometrics and solid cybersecurity practices to fight this growing area of crime. Online U.S. By Elizabeth Judd. New account fraud.

Let's personalize your content