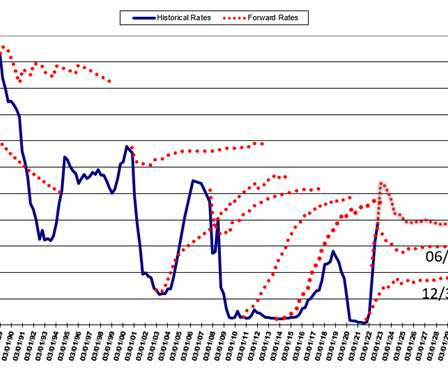

Reduce Credit Spreads to Increase Return

South State Correspondent

MAY 20, 2024

In last week’s article ( here ), we discussed why category and geographic diversification may be unfeasible for many community banks. We concluded that after a community bank sets limits on loan categories, the added benefit of geographic or loan category diversification is nullified.

Let's personalize your content