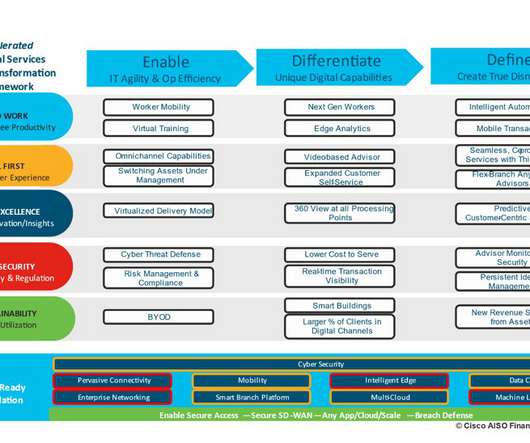

Americas FSI Digital Commentary: 3 Ways to Accelerate Digital Strategy in 2023

Cisco

JANUARY 10, 2023

Whether a community bank or a credit union, regional insurer, or multi-national financial institution, cross-functional engagement with champions, key influencers and ultimate decision-makers also helps to eliminate silos inherent in the financial services industry. Cisco Financial Services Solutions. Previous FSI Commentary.

Let's personalize your content