Decoding SVB’s Failure & FDIC’s Special Assessment

Perficient

DECEMBER 1, 2023

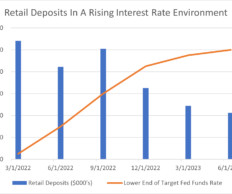

In various press releases, the Federal Deposit Insurance Corporation (FDIC) has highlighted that an estimated $16.3 billion of the total cost incurred from the failures of Silicon Valley Bank (SVB) and Signature Bank was designated for safeguarding uninsured depositors. Commencing with the first quarterly assessment period of 2024 (i.e.,

Let's personalize your content