What's With Regulator Agita Over Bank Commercial Real Estate Lending?

Jeff For Banks

MAY 20, 2017

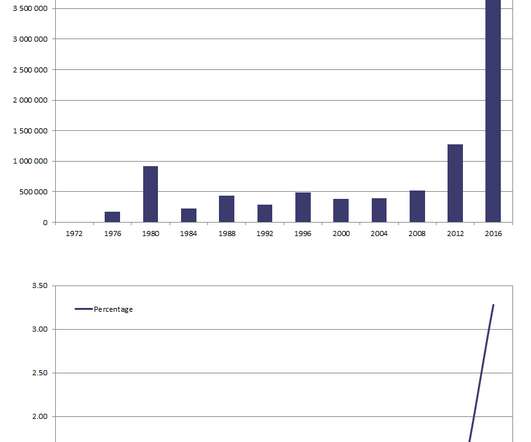

And regulators are getting anxious. and New York Community Bancorp called off their planned merger. Today, I read an American Banker article on how a multi-billion dollar bank is going to ramp up its business lending. How significant was CRE lending to the souring of bank loan portfolios?

Let's personalize your content