The Death of the Community Bank

Jeff For Banks

JANUARY 14, 2021

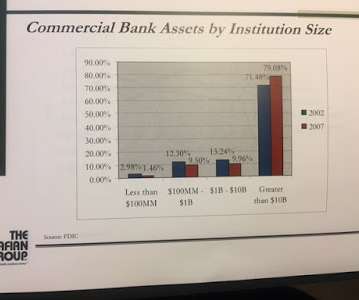

A mid-2020 survey performed by Cornerstone Advisors showed that 51% of retail customers that opened a new bank account within the last three months did so at a large, national bank. When I made that speech in 2008, there were approximately 8,500 FDIC-insured financial institutions and today that is around 5,000, a 40% decline.

Let's personalize your content