Job cuts piled up in payments this year

Payments Dive

DECEMBER 21, 2022

Payments companies chopped jobs as they confronted challenges posed by inflation and stagnating e-commerce growth.

Payments Dive

DECEMBER 21, 2022

Payments companies chopped jobs as they confronted challenges posed by inflation and stagnating e-commerce growth.

CFPB Monitor

DECEMBER 21, 2022

The Federal Reserve Board issued a final rule last week that establishes default rules for benchmark replacements in certain contracts that use the London Interbank Offered Rate (LIBOR) as a reference rate. LIBOR will be discontinued in June 2023. The.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

DECEMBER 21, 2022

With the bill unlikely to be passed by Congress this week, supporters of the Credit Card Competition Act are turning their attention to next year.

CFPB Monitor

DECEMBER 21, 2022

The Washington Department of Financial Institutions has adopted regulations effective December 31, 2022 to implement amendments to the Consumer Loan Act permitting licensed companies to allow licensed mortgage loan originators to work from their residence without licensing the residence as.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

DECEMBER 21, 2022

Hope Mehlman will serve as chief legal officer and general counsel at the financial services company.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankUnderground

DECEMBER 21, 2022

As is our annual tradition, we take a look back and present you once more with our most popular posts of the year. In case you missed any of them the first time round, the five most viewed posts for 2022 were: Predicting exchange rates. Cryptoassets, the metaverse and systemic risk. Capitalising climate risks: what are we weighting for? The impact of shipping costs and inflation.

The Paypers

DECEMBER 21, 2022

Walmart Canada has partnered Western Union to integrate its cross-border financial services platform and offer online money transfer services to customers on Walmart.ca.

TrustBank

DECEMBER 21, 2022

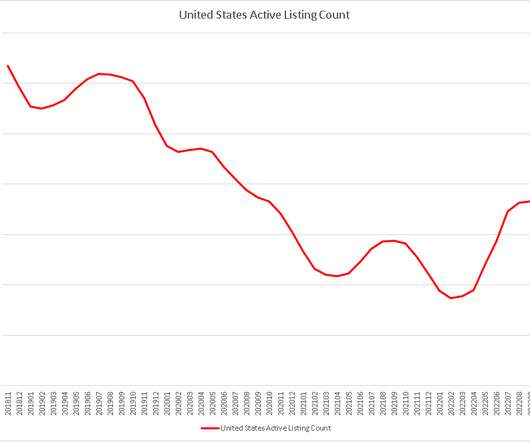

2022 has been a challenging year for the markets and especially for residential real estate. Individuals looking to purchase a home have been negatively impacted by rising mortgage rates, which have significantly increased the cost of their expected monthly mortgage payment. Indeed, mortgage rates have risen significantly, adding to the cost of a mortgage.

BankInovation

DECEMBER 21, 2022

Demand for core provider Temenos’ services remains strong amid a focus on digital transformation among banks. The $36.4 billion Bank of Queensland, based in Queensland, Australia, in Q3 selected Temenos’ cloud-based platform for its retail banking business, a spokesperson for Temenos told Bank Automation News. The Geneva-based tech provider’s other Q3 bank contracts include: $67 […].

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

The Paypers

DECEMBER 21, 2022

The Central Bank of Cyprus (CBC) has launched an Innovation Hub in the field of financial technology (fintech), to encourage and support domestic financial innovation, according to Cyprus Mail.

BankInovation

DECEMBER 21, 2022

American Express has launched business-to-business payments network AmEx Business Link, allowing commercial clients to support several types of payments including card, non-card, domestic and cross-border transactions. The API-based solution connects to a variety of technology platforms and provides buyers and sellers the ability to choose in real time how they want to be paid.

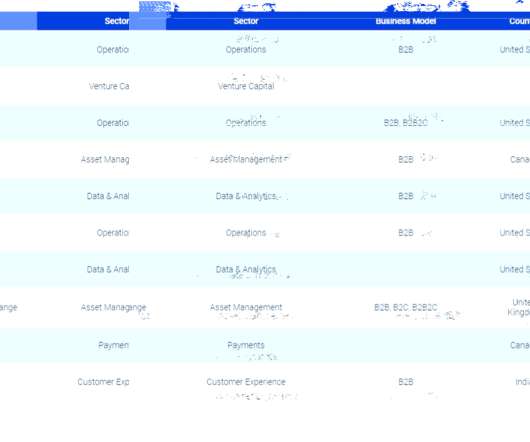

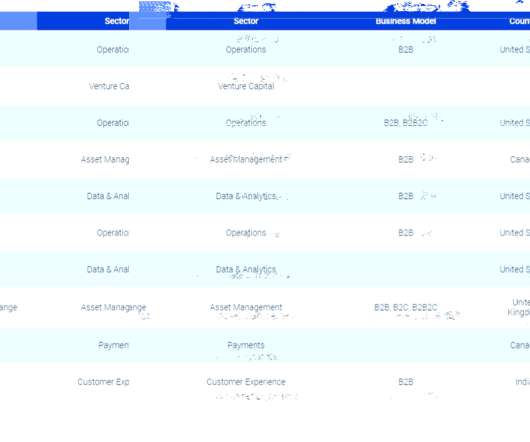

CB Insights

DECEMBER 21, 2022

The FTX bankruptcy was a reckoning for the crypto industry. In the aftermath of the exchange’s collapse , rival Binance ’s CEO Changpeng Zhao (CZ) said “consumer confidence is shaken.” Asset manager and well-known crypto investor Ark Invest stated the event could “delay institutional adoption by years.” Given the turmoil of 2022, institutional investors in crypto have two major priorities: quality and trust.

BankInovation

DECEMBER 21, 2022

If you’ve ever renovated your home, you know it can be a difficult process. Eating dinner in your garage for six months isn’t exactly a picnic, but the end result—a beautiful new kitchen where you’ll create meals and memories for years to come—makes the journey worthwhile. Implementing a new software solution at your financial institution […].

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

DECEMBER 21, 2022

Polygon blockchain has partnered with neobanking app hi and Mastercard to introduce a platform that allows users to create a personalized, web3-focused NFT debit card.

Image Works Direct

DECEMBER 21, 2022

As we prepare to gather and graze on goodies galore this holiday season, we wanted to take the chance to thank you for making 2022 one elf of a year! From toying with new ideas to creating ear-resistible designs, this year has been one for the books. After tinkering and toiling all year long, it’s time to give our worker elves a break.

The Paypers

DECEMBER 21, 2022

Quadient , a company helping businesses with customer connections through digital and physical channels, has announced a new accounts payable (AP) automation cloud solution.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

DECEMBER 21, 2022

Poland-based fintech Conotoxia has launched a multi-currency card 2.0 to enable cardholders to share their payment cards with family or business associates.

American Banker

DECEMBER 21, 2022

The Paypers

DECEMBER 21, 2022

Visa has proposed a new design for blockchain accounts that could potentially allow Ethereum users to perform auto-payments from a self-custodied wallet.

American Banker

DECEMBER 21, 2022

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

DECEMBER 21, 2022

The European Central Bank (ECB) has announced the results of the most recent review of its risk control framework for collateralised credit operations.

The Paypers

DECEMBER 21, 2022

Digital payment and banking technology provider i2c has partnered North International Bank (NIBank) to launch a Mastercard Black Card in Latin America.

American Banker

DECEMBER 21, 2022

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content