5 New Year’s Resolutions For Any Sized Bank That You Must Get Right in 2023

South State Correspondent

JANUARY 4, 2023

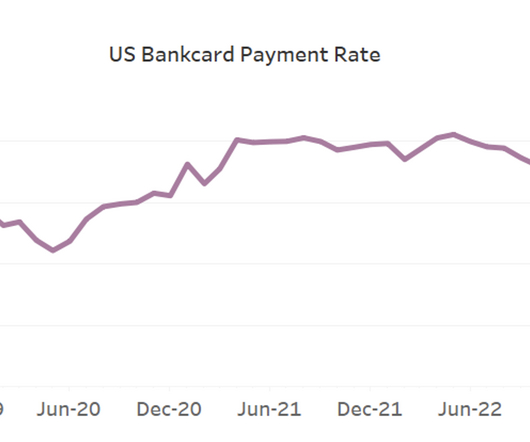

Charlotte, Houston, Phoenix, New York, Austin, Denver, Orlando, Miami, and Nashville, many banks have not adjusted pricing or their credit appetite. For 2023, banks need to prioritize interest rate risk management and credit accuracy as a top priority. That market share has come mainly from regional and community banks.

Let's personalize your content