Black-run bank channels capital infusion into digital upgrades

American Banker

MARCH 16, 2021

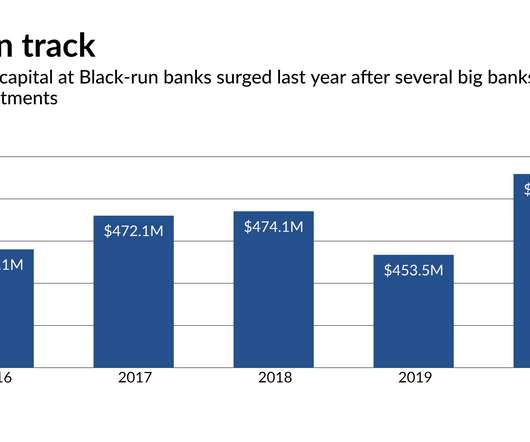

M&F Bancorp in North Carolina plans to use some of the $18 million it received from big banks to make overdue improvements to its commercial lending platform. ]].

Let's personalize your content