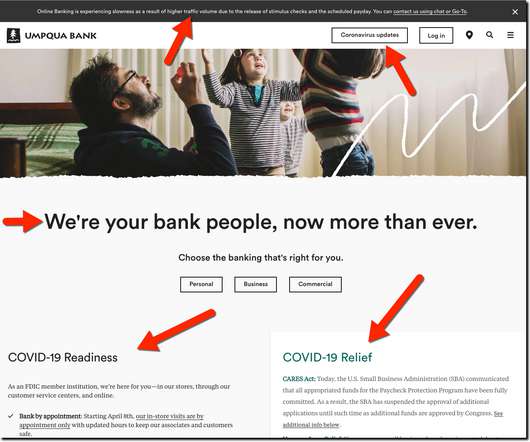

Top Social Media Trends to Pay Attention to for Financial Brands

Social Assurance

JANUARY 11, 2021

This is important for financial brands to pay attention to for two primary reasons. Exploring and implementing an eCommerce outlet, and doing so on the world’s largest social platform, is a realistic alternative for them that won’t require substantial capital investments. Do we have your attention now?

Let's personalize your content