Credit Unions Unite Behind Digital Banking

PYMNTS

DECEMBER 27, 2019

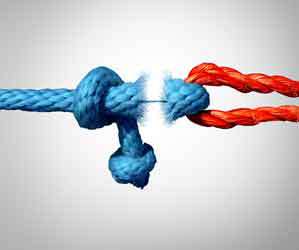

Specifically, the metamorphic impact of mobile open banking and instant payments has been the first real test of the trust bond that holds CUs together. With the possible exception of FinTechs that stand to gain from customer defections and perhaps some legacy banking competitors, no one is rooting against the CUs.

Let's personalize your content