The Death of the Community Bank

Jeff For Banks

JANUARY 14, 2021

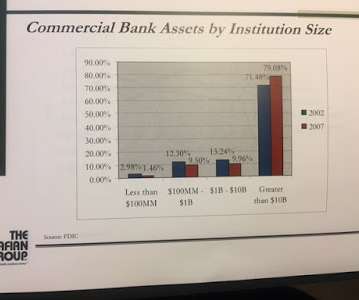

In June of 2008 I gave a speech titled "The Death of the Community Bank" and in that speech I made predictions. Prediction: The General Bank will become extinct. Much like competitors nip at community banks' customers. Eighteen percent of that group opened an account at a digital bank. Result: Mixed.

Let's personalize your content