GAO report on household access to banking services finds limited availability of small-dollar loans from banks and credit unions

CFPB Monitor

APRIL 13, 2022

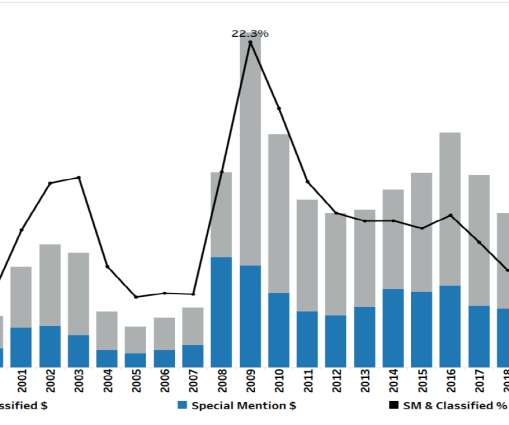

The GAO states that from 2010 through 2020, the CFPB, Federal Reserve, FDIC, and OCC have issued or rescinded at least 19 actions related to small-dollar loans, including rulemakings and policy statements.

Let's personalize your content