GAO report on household access to banking services finds limited availability of small-dollar loans from banks and credit unions

CFPB Monitor

APRIL 13, 2022

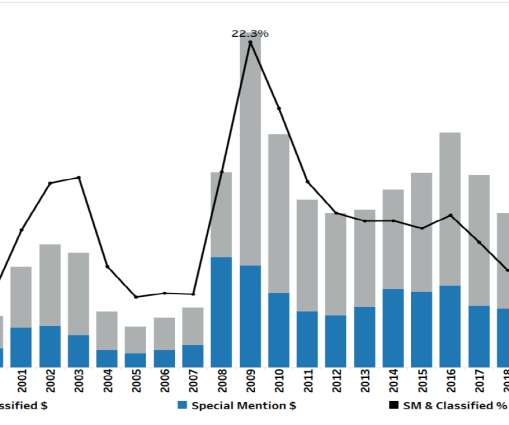

A report recently issued by the Government Accountability Office titled “ Banking Services: Regulators Have Taken Actions to Increase Access, but Measurement of Actions’ Effectiveness Could Be Improved ,” strongly suggests that banks and credit unions are unlikely to increase their small-dollar lending as consumer advocates contend.

Let's personalize your content