Study Sacks FDIC Fears on Brokered Deposits

Long Lasting Ideas

JUNE 28, 2018

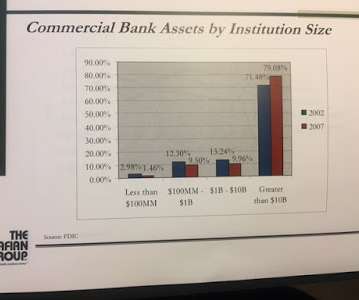

Subprime mortgages, greedy big banks and brokered deposits were at the root of the 2007 financial crisis, or so goes the case of federal regulators who helped saddle institutions big and small with Dodd- Frank. Continue reading Study Sacks FDIC Fears on Brokered Deposits at Bank Marketing Strategy + Ideas.

Let's personalize your content