The Death of the Community Bank

Jeff For Banks

JANUARY 14, 2021

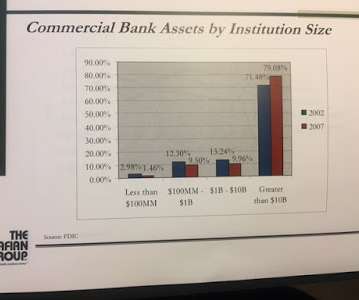

When I made that speech in 2008, there were approximately 8,500 FDIC-insured financial institutions and today that is around 5,000, a 40% decline. Prediction: Community Banks with < $10 billion in total assets will continue to lose market share. Eighteen percent of that group opened an account at a digital bank. Result: Mixed.

Let's personalize your content