Get your ducks in a row: HVCRE risk management

Abrigo

JULY 25, 2017

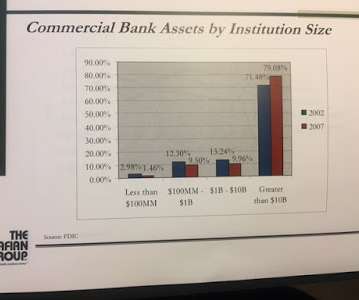

In a recent Sageworks webinar Robert Ashbaugh, senior risk management consultant at Sageworks, discusses High Volatility Commercial Real Estate (HVCRE) lending best practices. That 13% represented 80% of the losses to the FDIC insurance fund. How did we get here?

Let's personalize your content