Commercial Real Estate or Business Lending: Which Is Better?

Jeff For Banks

APRIL 30, 2022

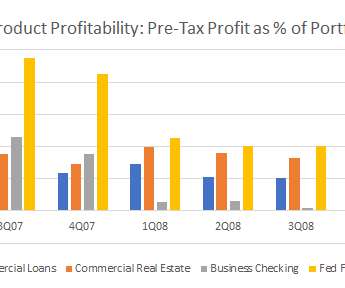

Me: Commercial Real Estate loans are the most profitable product in a community bank's arsenal and have been through various interest rate environments. The charts below show the pre-tax profits as a percent of the total product portfolio during different rate scenarios compared to the Fed Funds Rate.

Let's personalize your content