Reflections 2022: The Power of Patents and the People Behind Them

FICO

DECEMBER 12, 2022

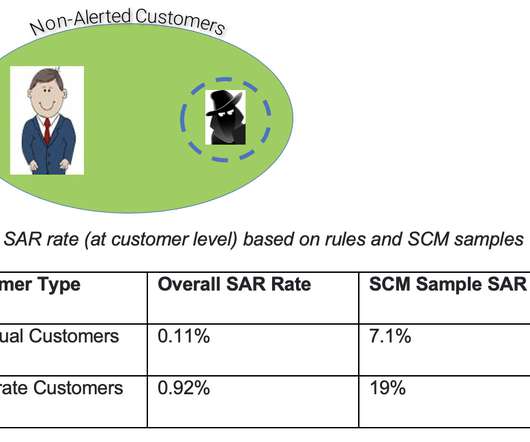

Reflections 2022: The Power of Patents and the People Behind Them. In 2022, FICO was granted 11 new U.S. Mon, 12/12/2022 - 16:00. As 2022 draws to a close I am reflecting on what has been a very challenging year for the world at large. This technology is incorporated into FICO® Falcon® Fraud Manager. FICO Admin.

Let's personalize your content