The Death of the Community Bank

Jeff For Banks

JANUARY 14, 2021

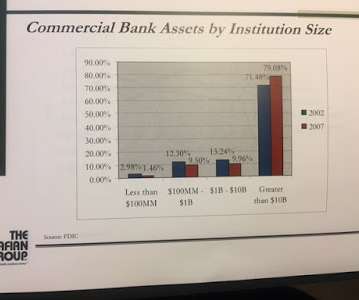

In June of 2008 I gave a speech titled "The Death of the Community Bank" and in that speech I made predictions. Much like competitors nip at community banks' customers. Two percent opened an account at a community bank. And I had ING Direct as an example of who might be the lightkeeper's cat to the community bank.

Let's personalize your content