The Federal Home Loan Bank System: Lender of Next-to-Last Resort

Jeff For Banks

JUNE 4, 2018

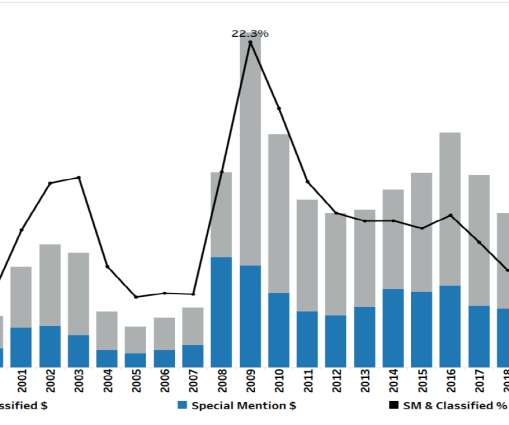

"The FDIC recently has observed instances of liquidity stress at a small number of insured banks." So opened the Summer 2017 FDIC Supervisory Insights issue. Regulators and consultants promulgate this untruth. He was confident in his bank's liquidity position, but felt regulators could artificially create a liquidity problem.

Let's personalize your content