Today In Payments: Wirecard Forces German Accounting Regs Reboot; Consumers Sour On Travel Rewards Cards

PYMNTS

JUNE 29, 2020

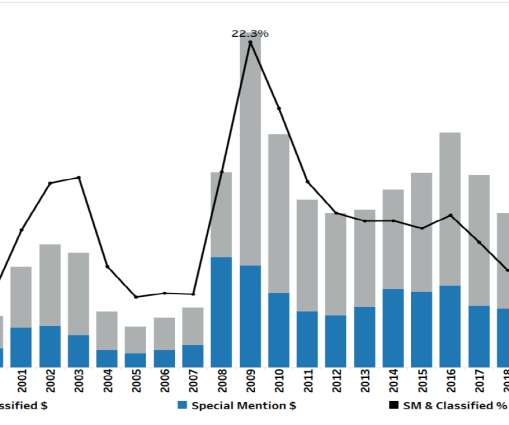

FDIC) is looking to modernize bank reporting. FDIC Looks To Modernize Bank Reporting. Two decades separate the 2001 collapse of Enron and the recent insolvency of Wirecard, but both firms’ stories (and flameouts) have similar trajectories. Plus, the Federal Deposit Insurance Corp. The Federal Deposit Insurance Corp.

Let's personalize your content