FICO® Resilience Index Can Improve Card Account Management

FICO

JUNE 27, 2022

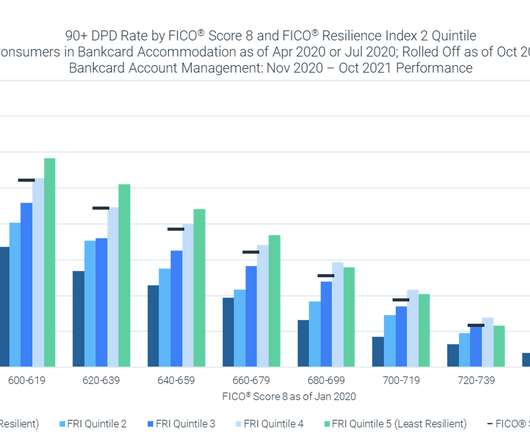

FICO® Resilience Index Can Improve Card Account Management. The New York Fed’s new report provides insight that credit card balances increased by $52 billion in the fourth quarter of 2021 and are only $71 billion off of pre-pandemic highs. Brendan lives in Albuquerque, New Mexico and holds B.S. by Brendan LaCounte.

Let's personalize your content