US Bankcards Industry Benchmarking Trends: 2023 Q1 Update

FICO

JUNE 1, 2023

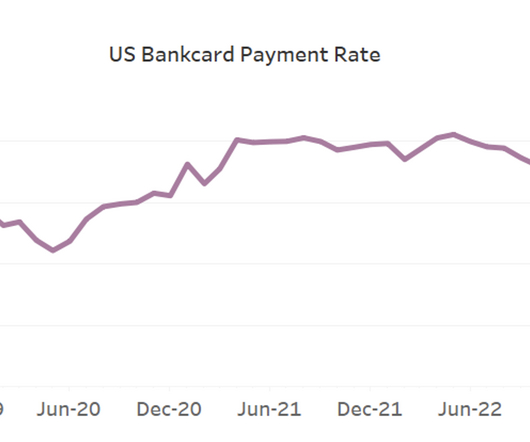

Trends in the macro environment are seen throughout the credit card industry Rising prices, increases in the cost of securing and carrying debt, and the fear of higher unemployment rates are trickling through to consumer behavior on credit cards. Credit card lenders are not only dealing with higher loss forecasts in 2023.

Let's personalize your content