Community Banks Debut FinTech Alliance

PYMNTS

NOVEMBER 13, 2018

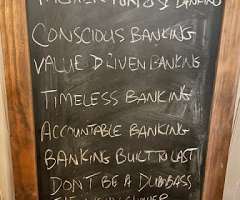

To that end, news came earlier this week in the United States that a dozen community and regional banks have formed a group aimed at exploring the opportunities amid FinTech offerings. Among the names joining up are Citizens & Northern Bank (based in Pennsylvania), Inland Bank (Illinois) and Lincoln Savings Bank (Iowa).

Let's personalize your content