Treasurers Trust Big Data For Real-Time Risk Assessment

PYMNTS

JUNE 20, 2017

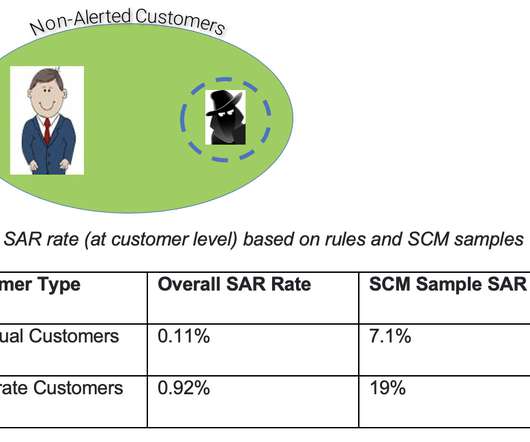

But Big Data lands new capabilities in the hands of corporate treasurers and other executives that yields active, real-time assessments of risks from multiple angles, from counterparties to compliance. A weak data management strategy could heighten the risk of non-compliance.

Let's personalize your content