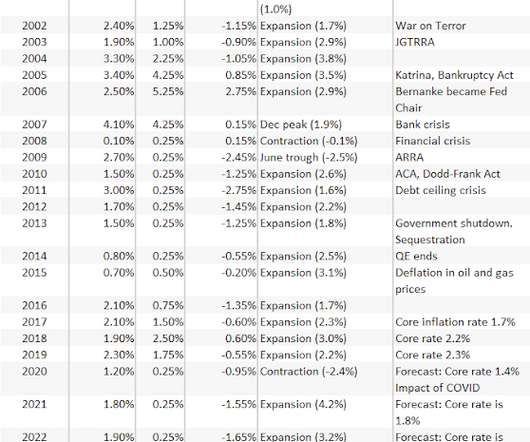

Bank Customers Lose Real Money

Jeff For Banks

OCTOBER 15, 2021

You've been conservative, preferring the stability and security of bank deposits versus the gyrations of the market. Sure, your home value declined, but what does that mean to someone with little to no mortgage and isn't in the market to sell? Heck, maybe there'll be a reassessment and your real estate taxes will go down.

Let's personalize your content