Weighed down by debt? Revisiting the link between corporate debt overhang and investment

BankUnderground

SEPTEMBER 28, 2021

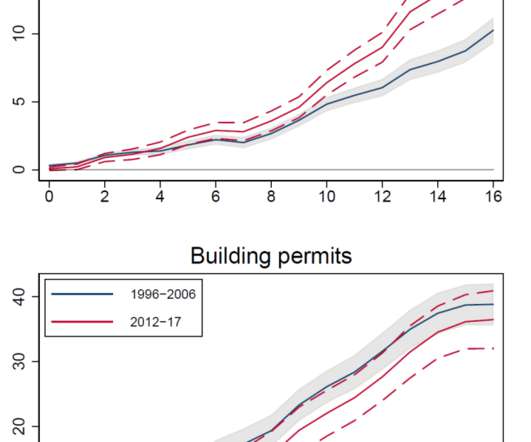

Bruno Albuquerque. I find that persistent debt booms led financially constrained firms to cut back on investment, across both capital expenditures and intangible assets. Vulnerable firms tend to have weaker fundamentals, face high corporate financing costs, have lower ICRs , and invest less ( Albuquerque (2021) ). Main results.

Let's personalize your content