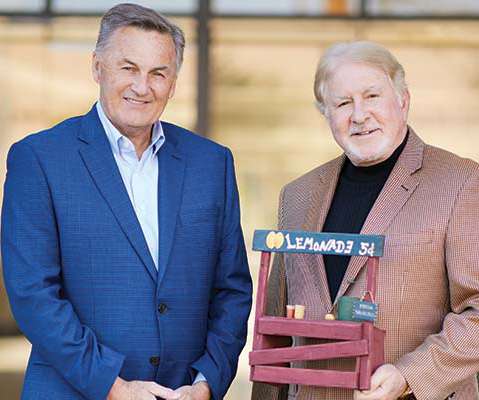

Scottsdale Community Bank: Making microloans

Independent Banker

JANUARY 31, 2023

The technology it uses allows it to maximize efficiency while minimizing costs in its operations. Scottsdale Community Bank’s Lemonade Stand Loan Program offers microloans—up to $25,000 each—to small businesses and individuals who own businesses or operate nonprofit organizations.

Let's personalize your content