FICO Survey: US Consumers’ Payment Methods Linked to Fraud

FICO

FEBRUARY 16, 2022

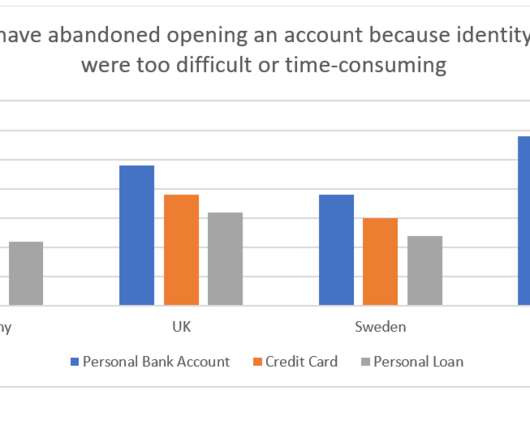

What are some of the themes we’ve seen that banks should look out for? It's not a surprise that the COVID-19 pandemic accelerated the adoption of digital banking. US customers and their banks are familiar with different types of fraud including card, identity, and payment related frauds. This could be why U.S.

Let's personalize your content