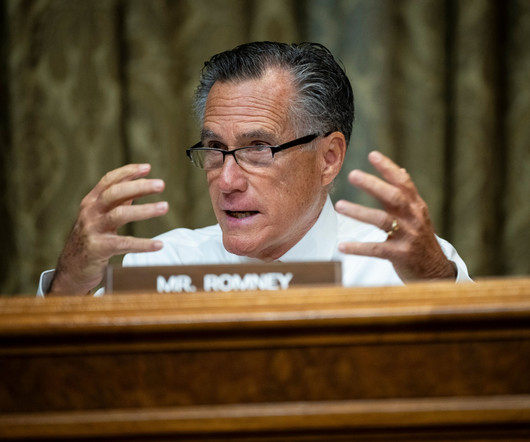

Senators urge FDIC to act on pending ILC applications

American Banker

MARCH 13, 2024

to exercise transparency and expedience in evaluating industrial loan company applications, which grant a type of charter industry experts say is unlikely to be issued in this administration. A bipartisan group of senators called on the Federal Deposit Insurance Corp.

Let's personalize your content