Commercial Credit Trends – Where to Tread Carefully

South State Correspondent

MAY 23, 2023

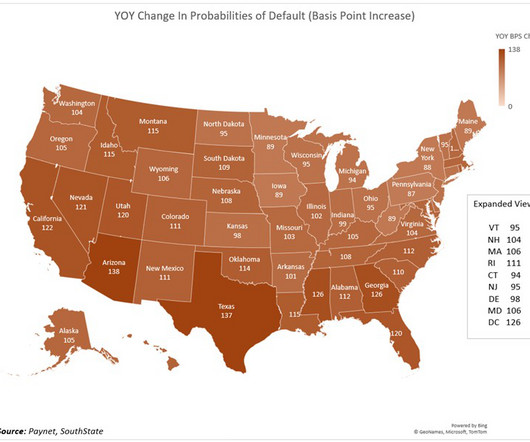

Lending is getting riskier. This data is critical for pricing, capital allocation, and marketing. As can be seen, the consumer is starting to feel the credit shock first while commercial lending is still performing. Minnesota, North Dakota, and Iowa were the least risky states to lend into.

Let's personalize your content