Scottsdale Community Bank: Making microloans

Independent Banker

JANUARY 31, 2023

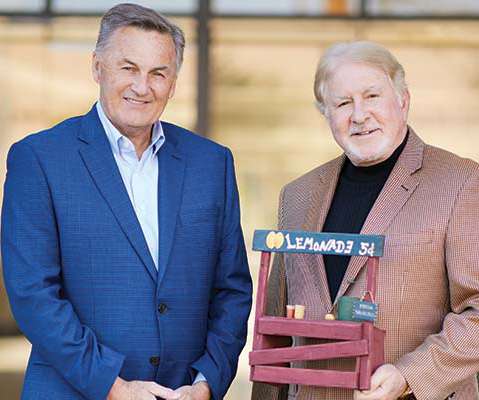

Inspired by the entrepreneurship of lemonade stands, Scottsdale Community Bank created a microloan program. Photo by Brandon Sullivan De novo Scottsdale Community Bank set out to provide microloans to small and mid-size businesses, family organizations and nonprofits—a project that was inspired by the humble lemonade stand.

Let's personalize your content