As Consumers Embrace eCommerce, Tax Complexity Grows

PYMNTS

NOVEMBER 25, 2019

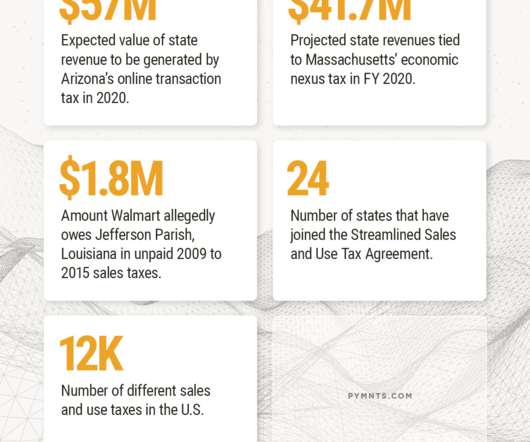

The Supreme Court ruling has started the ball rolling for states and municipalities to tax eCommerce – specifically, out-of-state firms and online marketplaces. But there have already been disputes making their way through the courts, as detailed in the latest Next-Gen Sales Tax Tracker.

Let's personalize your content